Never be surprised

by extremes again.

Outliers are in. Start planning like it.

Award-winning, next-generation grid forecasting where weather, climate, and energy meet — for the next hour, the next decade, and anywhere in between.

Risk

Traditional forecasts miss 97% of extreme events

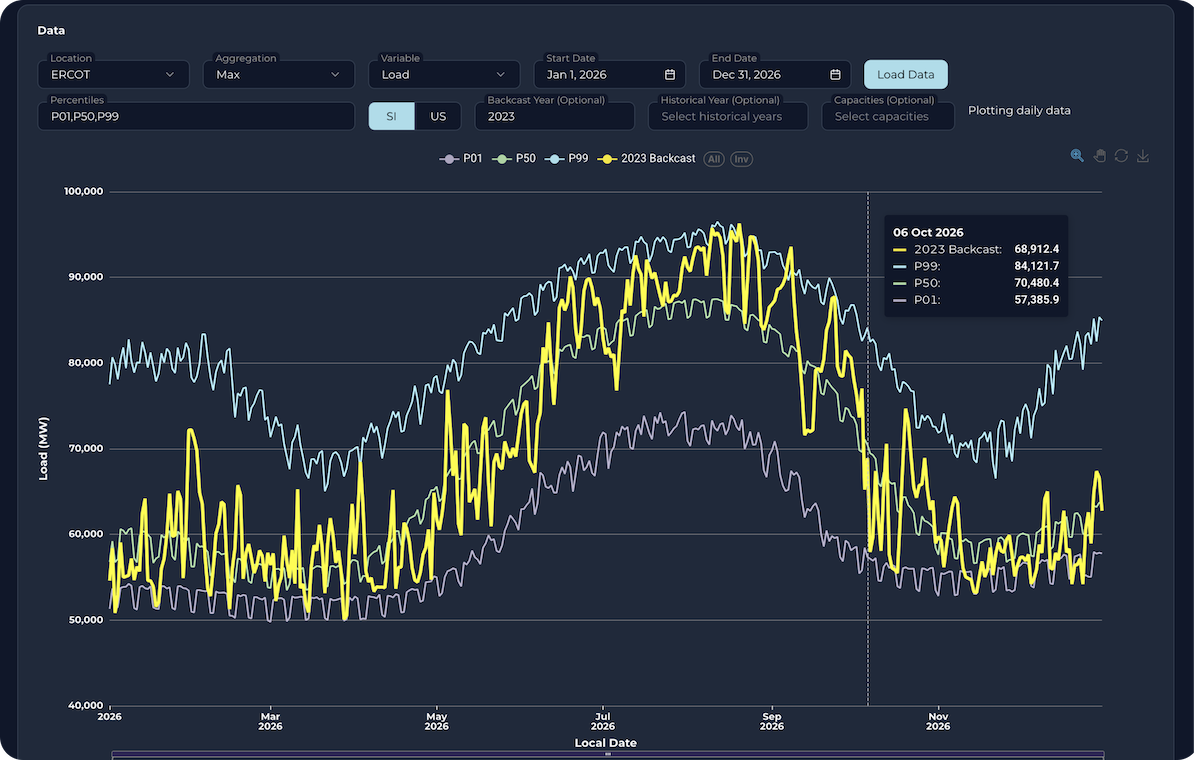

Grid dynamics are changing fast: extreme weather events, data centers, electrification, renewables. Events that used to be outliers aren’t outliers anymore.

Forward-looking forecasts based on legacy modeling approaches or limited historical data don’t reflect this evolving reality. They paint a dangerously incomplete picture that leaves you exposed to unseen risk.

Sunairio ONE generates 1,000 ensemble forecast paths, providing a complete, accurate picture of risk that others can’t. We capture 97% of hourly extremes that traditional forecasts miss — up to 500 hours/year.1

Forward-looking forecasts based on legacy modeling approaches or limited historical data don’t reflect this evolving reality. They paint a dangerously incomplete picture that leaves you exposed to unseen risk.

Sunairio ONE generates 1,000 ensemble forecast paths, providing a complete, accurate picture of risk that others can’t. We capture 97% of hourly extremes that traditional forecasts miss — up to 500 hours/year.1

Learn more

Fidelity

Unparalleled accuracy and correct probabilities

Generic forecast solutions are plagued by problems: systematic biases, low temporal and spatial resolutions, discontinuous time horizons, chronic underdispersion, and ignorance of climate dynamics. As a result, they’re not readily actionable in power markets.

By contrast, Sunairio ONE beats publicly available forecasts (including major AI forecasts) in two important dimensions: the accuracy of our expected forecasts and the truthfulness of our ensemble spread. We’ve spent years learning these nuances and getting the science right — picking up an NSF award along the way and continuously improving our technology.

Sunairio ONE provides a faithful, seamless view of weather-based hourly risk that spans operational and planning time horizons, allowing you to make business decisions from data you can trust.

By contrast, Sunairio ONE beats publicly available forecasts (including major AI forecasts) in two important dimensions: the accuracy of our expected forecasts and the truthfulness of our ensemble spread. We’ve spent years learning these nuances and getting the science right — picking up an NSF award along the way and continuously improving our technology.

Sunairio ONE provides a faithful, seamless view of weather-based hourly risk that spans operational and planning time horizons, allowing you to make business decisions from data you can trust.

Learn more

Insight

Data you can’t get anywhere else

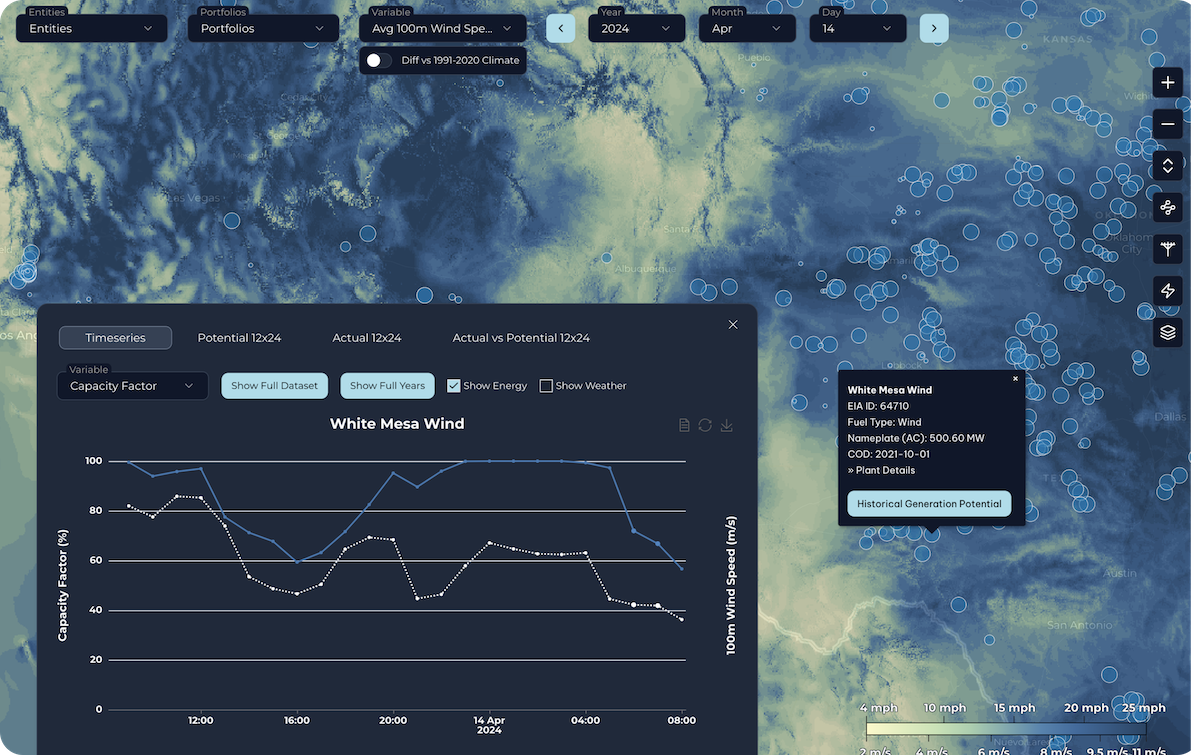

We built our own high-resolution historical weather dataset because traditional sources aren’t sufficient to model critical risks to the modern grid: asset-level wind and solar variability.

Sunairio High-resolution Earth Data (the SHED) is created at a 100x higher resolution than alternative datasets like the ECMWF’s ERA5, more accurately capturing the local weather variability that drives variable wind and solar generation.

Available for the period 1950–present over the Continental US and continuously updated, the SHED provides Sunairio with a unique, powerful training set for our next-generation weather forecasts and asset-level energy models.

We don’t take short cuts. The SHED is rigorously validated and proven to be more accurate than NREL’s benchmark renewables datasets — but updated to the present and available for 10x the number of years.

Sunairio High-resolution Earth Data (the SHED) is created at a 100x higher resolution than alternative datasets like the ECMWF’s ERA5, more accurately capturing the local weather variability that drives variable wind and solar generation.

Available for the period 1950–present over the Continental US and continuously updated, the SHED provides Sunairio with a unique, powerful training set for our next-generation weather forecasts and asset-level energy models.

We don’t take short cuts. The SHED is rigorously validated and proven to be more accurate than NREL’s benchmark renewables datasets — but updated to the present and available for 10x the number of years.

Learn more

Customers and partners